THE PEOPLE PUSH BACK…2003

In 2003 Portnoff Law was in a class action lawsuit for their illegal practices and excessive fees. Another case that mirrored this litigation was Pentlong v GLS (GLS is the “PLA” of Philadelphia). Jane Orie sponsored a bill that allowed tax claims to add attorney fees and made this law retroactive back to 1996. So Portnoff didn’t lose a dime. Jane Orie was also part of the corruption decade. A few years after this enactment, she was sent to prison for corruption, even submitting fraudulent documents in her own trial.

She addressed the Senate floor with her sponsored bill and spoke how people that are delinquent in paying taxes are a burden to the citizens that paid on time. Her interpretation of the history of the MCTLA was flawed but surprisingly no one bothered to research the previous amendments..

Senator Jane Orie explained the purposes of the bill:

First, the amendments to the Municipal Claim and Tax Lien Act clarify the rights of municipalities and those who hold rights from municipalities in the process of collecting all claims under this Act. This is especially important to Allegheny County because the Municipal Claim and Tax Lien Act is the principal statute that governs tax collection and municipal claim enforcement actions in the County.

Second, these amendments reaffirm the General Assembly's intentions since the passage of the Act almost 80 years ago. Namely that the recoupment of costs expended to retain competent, experienced legal counsel to enforce claims for payment of taxes is a legitimate expense that should be recoverable against the small minority of property owners who are tax scofflaws.

Third, these amendments streamline the process of enforcing claims for taxes under the Act. These changes add the important benefit of reducing the costs and expenses associated with these actions. Legislative Journal-Senate, July 28, 2003, at 859 (statement of Sen. Orie).

(As Much as Jane Orie and the third party collectors preach how the municipalities and districts have to incur expenses due to the delinquent taxpayer, the fact is the delinquent taxes are collected by the county tax claim bureau and the 5% fee they collect covers the expenses. There are no fees to pass to the already struggling homeowner, only the fees incurred by contracting with these predatory companies.)

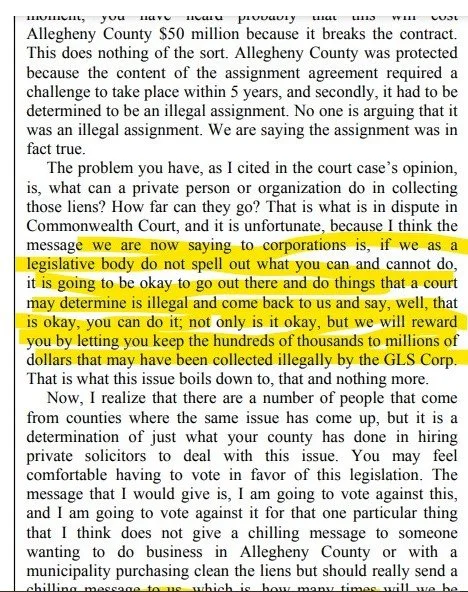

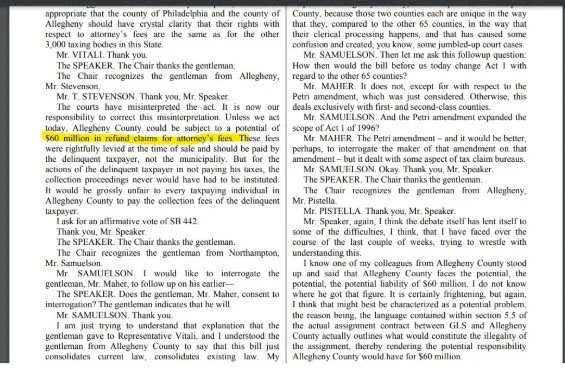

The bottom line is, GLS was collecting illegally (as Portnoff was) But Philadelphia would have to pay 50 million back to taxpayers if this wasn’t passed. The journal of the house floor shows the conversations and our representatives are stating this was done illegally and really shows which representatives have their constituents best interest in mind. (ExH)The obvious deceptive language of a purely “technical” amendment while changing the statute's purpose is frustrating.

Of course the bill passed and the private companies benefited, while the citizens pay for the corruption in politics. This was a green light for more amendments for more profits for the tax collectors. In 2004 more wording was added to specify claims, liens, taxes, fees, costs, districts, private companies, etc making sure to leave no option to question the legality of this law.

THE MUNICIPAL CLAIMS AND TAX LIEN ACT MADE THIS TAX FARMING POSSIBLE

ALSO CAMPAIGN FUNDING AND LOBBYING LINED THE POCKETS OF CORRUPT POLITICIANS, MAKING PAY TO PLAY LAW PASSING NORMAL IN HARRISBURG

This has been a problem for a long time. I have been researching this for four years and this process seems like it was created out of greed and aided by corruption. Currently its become the norm, I believe its time to stop putting families out of their homes.

Struggling families already feeling overwhelmed with this economy are now facing losing everything, while being bombarded with legal paperwork, feeling like there's no solution. It’s reported that 90% of these cases go unanswered, and the government entities receive no benefit from contracting with these companies.

This also contributes to communities of rental properties, blight, and out of state landlords. House flippers and investment companies buy the property at these tax sales and rent them out but don’t maintain the buildings. Property values will continue to go down while rental costs rise, contributing to increased evictions and more social government programs to be drawn from.

The government agencies that help people stay in their homes are acting against the government agencies that are causing the problem. Local municipalities contract with Portnoff, struggling homeowners apply for help to avoid tax sales, so other government agencies are paying a private tax collector and paying fees for the homeowner. This is a huge loss of money because there was already a government agency to collect delinquent taxes. A relative of this law firm is now advertising for people to apply for PAHAF grants for municipal collections and property taxes.

The Homestead Tax grant takes 300 to 500 dollars off my school taxes, but the relief is short lived when the school district farms out the tax responsibility to private debt collectors. I end up with an inflated tax bill which leaves myself and other homeowners unable to become current.

The school districts also assign liens to private companies, and still use the same collectors to collect for another profit making company. How does a fourth (not third) party collector get to benefit from legislature directed for municipalities and school districts? How can they be allowed to take someone's property? (their home, where they reside, where their belongings are, and their families.

PG 1229-1236