LANSFORD BOROUGH PA

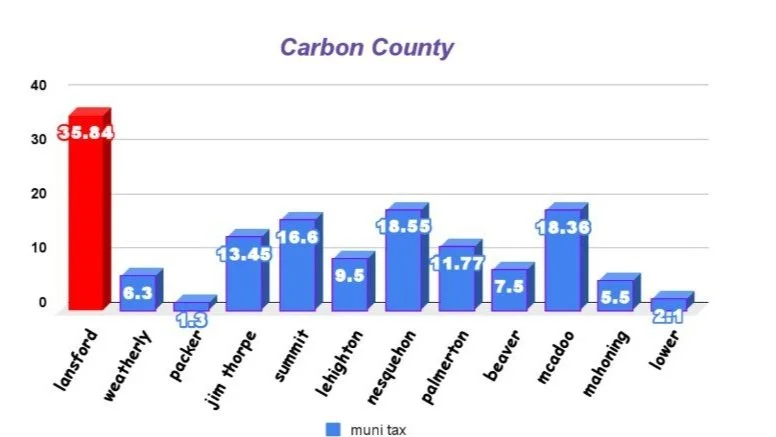

WEATHERLY 214,900 x 10.3 = 221.34

CONYNGHAM 275,000 x 2.88 = 792.00

PALMERTON 185,000 x 14.97 = 276.94

SUMMIT HILL 137,500 x 21.25 = 292.18

LANSFORD 89,900 x 36.84 = 331.19

COUNTY WIDE REASSESSMENT

Lansford council voted against a county wide reassessment. The council sets the millage rates, so why can’t they be in favor of bringing the home values up and lower the tax rates at the same time?

Higher home values would make Lansford more marketable to families and lower taxes could bring businesses and jobs to the area.

IF YOU COMPARE THE OTHER MUNICIPALITIES AVERAGE HOME VALUES TIMES THEIR MILLAGE RATE YOU CAN SEE HOW A REASSESSMENT AND MILLAGE REDUCTION COULD BENEFIT THE BOROUGH.

THE MILLAGE FOR THE BOROUGH EXPENSES ARE CAPPED AT 30 MILLS SO IT WOULD GIVE THE COUNCIL MORE WIGGLE ROOM TO HIKE THE TAXES IN THE FUTURE.

post your thoughts

QUESTIONS, COMMENTS, CONCERNS…