invest in distress…

It’s surprising to find out that our school districts receive a financial score. The homeowners in the district are a very big factor. The information used to determine their credit score includes the economy, the median income of the households, the total per capita tax base, and the enrollment compound growth rate over three years.

School districts are separate government entities that are allowed to issue their own debt. Government debt is very attractive to investors because they issue tax exempt government bonds.

Issuing debt pays todays bills but makes any growth in revenue a desperation instead of a well thought plan. So when a school starts speaking of building a new facility it really isn’t for the kids, they’re out of money.

User Message: Dear House of Representative Doyle Heffley; ,

I would like to thank you for speaking out on Panther Valley raising taxes due to the homestead exemption. They stated the same thing last year adding that the money for the homestead is taken from their budget. I wrote a letter to the editor saying that they wee receiving 1.1 million dollars and they couldn’t legally raise taxes due to the Homestead money.

But you said in your letter we need to have an honest conversation about school funding. I wrote letters to the Times News, the Attorney General, the Consumer Financial Protection Bureau and you about how bringing Portnoff in to collect delinquent taxes was making people lose their homes. No one replied. .

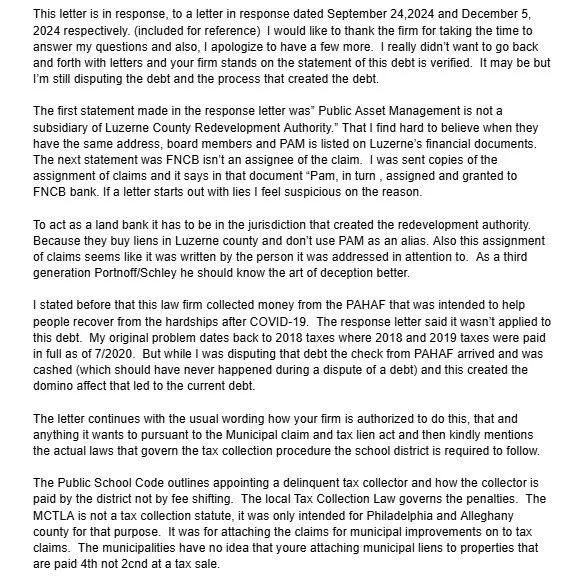

While I was researching this collection scheme I found out the school district assigns (sells) the liens to Public Asset Management (Luzerne County Redevelopment Authority) for 60-80 cents on the dollar. The homeowner pays 3-4 times the original amount to keep their home. None of this extra money goes to the school district, the poor are subsidizing the rich.

These liens are paid and the interest keeps going being collected by Portnoff along with the attorney fees and costs. PAM receives a percent, even though they file as a non profit, Municipal Revenue Service gets a percent for over seeing this process.. FNCB (US Bancorp) is the assignee of PAM and receive interest. Eckert, Seamons, Cherling, and Merlot Law issues bonds for the government debt, Stifel Niclaus is the bond underwriters, They both receive fees. PFM Financial Advisors and Pfm Distributors advise the district and receive percent's of the profits.

Of course Portnoff’s fees are the highest, 3 letters from Portnoff costs over 700 dollars before a sale is even scheduled. Taking it a step further, PLGIT the Pennsylvania pension pool of the local governments buy these bonds and pay sponsorship fees to the PA Association of Boroughs, the PA County Commissioners, the PA Association of Township Supervisors, the PA Municipal Authorities, Pa association of School directors and The Pa Municipal League.

This affects the most vulnerable in the communities. The poor and the elderly are more likely to have a home owned out-right and this steals the equity from the home owners and creates communities of blight and rental properties. On paper this resembles a Ponzi scheme and putting people out of their homes to be part of someone’s portfolio is investing in distress on a level they should be ashamed of. Thank you for your time

THE POOR SUBSIDIZE THE RICH..

-

PUBLIC ASSET MANAGEMENT

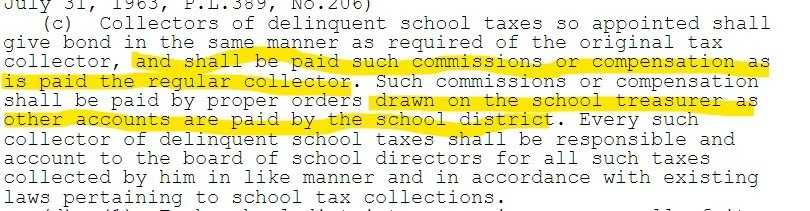

Portnoff states Public Asset Management isn’t the Luzerne County Redevelopment Authority operating under a non-profit alias

-

RESPONSE

RESPONSE LETTER TO pORTNOFF’S LIES

-

LUZERNE COUNTY REDEVELOPMENT AUTHORITY

PUBLIC ASSET MANAGEMENT AND LUZERNE REDEVELOPMENT HAVE THE SAME ADDRESS, BOARD MEMBERS AND PAM IS LISTED ON THE REDEVEL’S FINANCIAL DOCUMENTS

-

LAND BANK

A REDEVELOPMENT AUTHORITY CAN ACT AS A LAND BANK INSIDE THE BOUNDARIES OF THE JURISDICTION THAT CREATED IT

-

TAX LIEN ASSIGNMENT

THE SCHOOL DISTRICT SELLS THE LIENS TO PUBLIC ASSET MANAGEMENT FOR 60-80 CENTS ON THE DOLLAR AND MUNICIPAL REVENUE SERVICES BROKERS THE AGREEMENT

-

DELINQUENT TAX COLLECTOR

A SCHOOL DISTRICT CAN HIRE A COLLECTOR OF DELINQUENT TAXES BUT THE DISTRICT PAYS THE COLLECTOR NOT THE HOMEOWNER

-

mrs

municipal revenue services brokers the assignment of liens from the district to Public Asset manage ment

-

PFM

PFM ADVISORS AND DISTRIBUTORS ARE IN THIS MIX ALSO, RECEIVING FEES PAID BY THE POOR AND ELDERLY

-

TAX LIEN INVESTING

Description goes here -

PAM LISTED ON LUZERNE COUNTY'S FINANCIAL DOCS

Description goes here -

FNCB

PAM IS THE ASSIGNEE OF PANTHER VALLEY AND FNCB (BANCORP) IS THE ASSIGNEE OF PAM..A FOURTH PARTY DEBT COLLECTOR IS GRANTED THE SAME COLLECTION RIGHTS AS A GOVERNMENT AGENCY. HOW CAN THEY KEEP ADDING FEES TO A LIEN WHEN PAYMENT EXTINGUISHES A LIEN?

-

Public Asset Management (non-Profit?)