CREATING THE CONFUSION

In Pennsylvania, the late 1800’s to early 1900’s was the time when boroughs and townships were formed. With the newly formed communities, properties were benefited with roads, water, sewage and; of course, government taxes.

The local governments decided to form a system to charge the property owner for the improvements to their homes. An assessment on the improvements to their property. The Municipal Act of 1901 was the piece of legislation that originally described the collection of municipal claims, and provided a way to attach the claim to a tax lien.

The clear intent of the legislature In the Act of June 4, 1901, P.L. 364, was that the legal incident of lien was to attach to municipal claims for taxes, water rents, lighting rates and the like, and if, within the time limited, there should be filed of record the formal statutory declaration of this claim in detail, the lien would be preserved and relate back to the time when the rates were lawfully assessed or imposed. TOWNSHIP OF L. MERION v. MANNING ET AL | 95 Pa. Super. 322

When laws were codified, the existing laws were organized by subject and arranged into chapters. Notes are provided to outline the process of the finished statutes. It was clearly recognized and recorded in these notes, that tax claims were not taxes when pertaining to municipal claims and tax lien laws. The word “tax” was referring to municipal improvements.

This piece of legislation has historically caused confusion and headaches and has been altered/amended over the years too many times. I would suggest a full repeal and a reconsideration of the meaning, wording and overall need for the provisions listed in this Act.

No law shall be passed except by bill, and no bill shall be so altered or amended, on its passage through either House, as to change its original purpose.

(the best indication of the General Assembly's intent in enacting a statute may be found in its plain language)

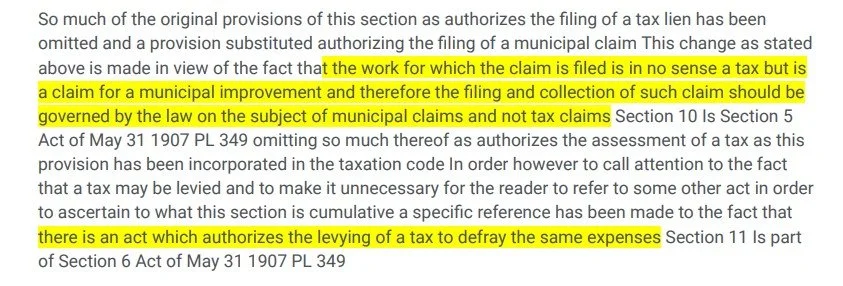

So much of the original provisions of this section as authorizes the filing of a tax lien has been omitted and a provision substituted authorizing the filing of a municipal claim This change as stated above is made in view of the fact that the work for which the claim is filed is in no sense a tax but is a claim for a municipal improvement and therefore the filing and collection of such claim should be governed by the law on the subject of municipal claims and not tax claims Section 10 Is Section 5 Act of May 31 1907 PL 349 omitting so much thereof as authorizes the assessment of a tax as this provision has been incorporated in the taxation code In order however to call attention to the fact that a tax may be levied and to make it unnecessary for the reader to refer to some other act in order to ascertain to what this section is cumulative a specific reference has been made to the fact that there is an act which authorizes the levying of a tax to defray the same expenses Section 11 Is part of Section 6 Act of May 31 1907 PL 349

Is part of Section 4 Act of May 31 1907 PL 349 The original provisions of the act provided that a copy of the notice should be sent to the borough tax collector and this for the purpose that this officer if the money was not paid within a certain time was required to file a tax claim for the amount of the assessment which could be collected as tax claims are collected under the Act of 1901 Attention is called to the fact that this is purely a municipal improvement and the amount assessed against the owners of real estate is in no sense a tax but is a municipal claim In view of this fact it seems rather inconsistent that the amount should be collected as a tax and not as a municipal claim and a change 26 Is part of Section 4

By direction of the General Assembly of 1913 ( Pamphlet Laws, 1913, page 250) the Legislative Reference Bureau was directed "to cause to be prepared, for adoption or rejection by the General Assembly, compilations, by topics of the existing general statutes, ar ranged by chapters and sections, under suitable headings, with accompanying lists of statutes to be repealed. " Also "to cause to be prepared codes of the existing laws on each of such topics, together with lists of statutes to be repealed , in the event of the adoption by the General Assembly of any of such codes."

Pursuant to this act several codes have been prepared by the bureau and will be submitted to the General Assembly of 1915 for its consideration. Among them is a codification of the general laws of Pennsylvania relative to Boroughs, a copy of which is herewith submitted for the criticism of those interested in the subject.

In preparing this code the law has been taken practically as it stands, changes being made only to clear up ambiguous provisions, eliminate redundancies and superfluous expressions, and harmonize conflicting statutes. A few minor changes have been made in matters of procedure so as to make the whole system logical and uniform so far as the nature of the material permits. All changes of any nature have been noted in the appropriate place in the Exposition. The concluding chapter of this bill contains a specific repeal of all general acts and parts of acts relating to boroughs. The object is to have all the borough laws of the State, other than local laws, comprised in one statute

Bar Meeting at Cambridge- Pennsylvania Lawyers to Consider Important Matters at Annual convention

One of the most important communications that will be considered by the State Bar association at its annual meeting next week at Cambridge Springs is the report of the committee on law reform. Two years ago the association adopted the following resolution: Resolved, That the state of law in respect to mechanics liens and municipal claims be the same is hereby referred to the committee on law reform, with instructions to report to the next meeting, and, in the event of their deeming is proper, recommending the enactment of such laws as may, in the opinion of the committee, meet the necessities of the case.

One year ago this committee reported relative to mechanics liens with a proposed act of assembly which was adopted by the association. At the meeting this year a report will be made with regard to municipal claims. The committee has interpreted the resolution to include tax claims, partially because the use of the words “municipal claims” in conjunction with “mechanic liens” seemed so to imply. And partially because all municipal claims for which liens are allowed are necessarily assessed under the right to tax and can find no other foundation upon which to rest for support.

It is exceedingly amusing to study the various decisions with the regard to the questions arising in municipal claims. It is held that special assessments are a species of taxation and, again, that they are not a species of taxation, that it is “sound without substance” to say that a special case was decided because Broad street Philadelphia, had a character different from ordinary city highways, or again that it was not so decided for that very reason that the assessments made to cover these local assessments are conclusive as to the benefits received and the amount of damages to be paid, or that the judiciary is without control of the matter. Another decision states positively that the judiciary will nevertheless control, and that the property owner cannot be made personally liable for the assessment. One judge decides that he can be made personally liable, that property exempt from the general taxes is exempt from these also, but another equally learned judge has held that it is not in fact exempt from them at all, but must pay them and that the foundation of the right to charge specially is the special benefit conferred on the particular property.

The General Assembly explicitly distinguished between tax claims and municipal claims in the Lien Law, (See, Act No. 153, P.L. 207, May 16, 1923, §40 (53 P.S. § 7111). Tax claims represent "proper, or general public contributions, levied and collected by the state, or by its authorized municipal agencies, for general governmental purposes," In re Broad Street in Sewickley Borough, 165 Pa. 475, 477, 30 A. 1007, 1008 (Pa. 1895). In contrast, municipal claims represent a "peculiar form[ ] of taxation or special assessments imposed upon property, within limited areas, for the payment of local improvements therein, by which the property assessed is specially and peculiarly benefited and enhanced in value to an amount at least equal to the assessment." Id.

CORRUPTION IN STATE AND LOCAL GOVERNMENT MADE IT EASY TO MAKE GENEROUS CONTRIBUTIONS TO CAMPAIGNS IN EXCHANGE FOR LAWS TO BENEFIT THE FOR-PROFIT TAX COLLECTING INDUSTRY WHILE STOPPING BILLS THAT WOULD PREVENT TAX FARMING